Tanzania is a dynamic and rapidly developing business environment, making it an excellent place for investors. The country has a stable political climate, a favorable geographical position in East Africa, and rich natural resources, making it offer numerous opportunities across various fields. The government is interested in promoting investment via pro-business strategies, tax incentives, and infrastructure. Whether you are looking to tap into the emergent consumer market or target opportunities in significant sectors like mining, agriculture, and technology, Tanzania provides a good climate for long-term growth. Doing business in Tanzania requires understanding local regulations, securing necessary permits, and building strong relationships. Key sectors include agriculture, tourism, and mining. Ensure you obtain your Tanzania eVisa for smooth entry and business engagements.

Why Invest in Tanzania?

Tanzania’s economy is primarily driven by agriculture, mining, tourism, and manufacturing. The government actively promotes foreign investment through policies that encourage business growth, infrastructure development, and economic reforms.

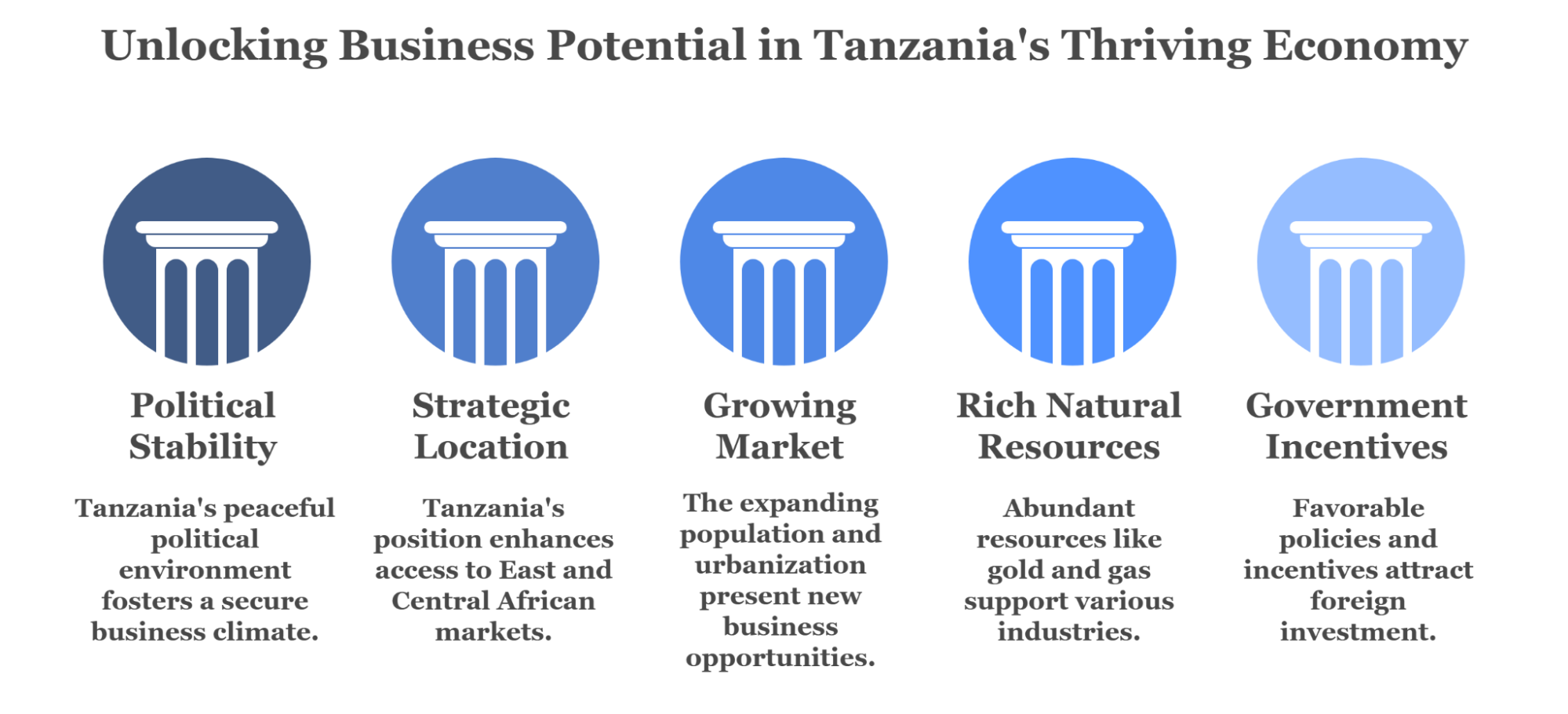

Key Advantages of Doing Business in Tanzania

The following are some of the significant advantages of doing business in Tanzania.

- Political Stability: One of Africa’s most stable countries, with peaceful transitions of power.

- Strategic Location: A gateway to East and Central Africa, with access to the Indian Ocean.

- Growing Market: A population of over 65 million, with increasing urbanization and middle-class growth.

- Rich Natural Resources: Includes gold, natural gas, uranium, and fertile agricultural land.

- Government Incentives: Investment-friendly policies, tax breaks, and free economic zones.

Economic Overview of Tanzania

The Tanzanian economy is diversified, with key sectors being agriculture, mining, tourism, and manufacturing. The country has experienced steady economic growth in the past decade, driven by infrastructure development, foreign investment, and economic reforms. Key economic indicators are:

- GDP Growth: Tanzania's GDP growth rate has averaged 6-7% per annum in recent years.

- Main Sectors: Agriculture contributes around 25% of GDP, while mining, tourism, and manufacturing are also key sectors.

- Natural Resources: Tanzania is rich in natural resources, ranging from gold, diamonds, natural gas, and Tanzanite (a valuable gemstone found only in Tanzania).

- Strategic Location: The location of Tanzania, being close to the Indian Ocean and a member of regional trade blocs like the East African Community (EAC) and the Southern African Development Community (SADC), makes it a gateway to regional markets.

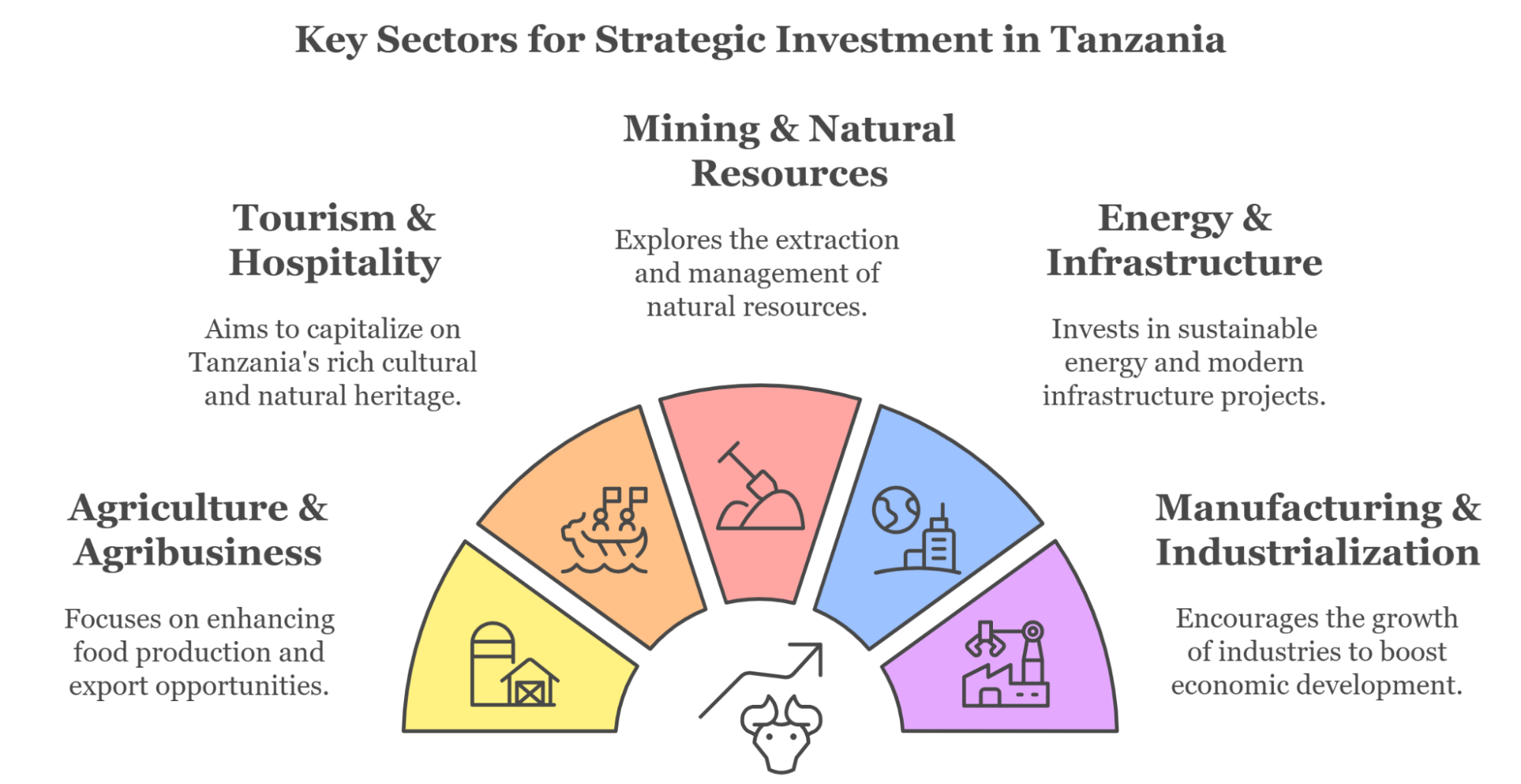

Top Sectors for Investment in Tanzania

Tanzania offers a wide range of investment opportunities across various sectors. The government has implemented policies to attract foreign investment, including tax incentives and simplified business registration processes

1. Agriculture & Agribusiness

Tanzania's agricultural industry is crucial to its economy, as it possesses vast arable land and a favorable climate for various crop production. The primary agricultural produce includes coffee, tea, cashew nuts, cotton, and maize, which are not only essential for local consumption but also for export. The industry provides numerous investment opportunities, particularly in agribusiness, agro-processing, and export trade. Farmers can diversify into value addition through food processing, packaging, and distribution, while investors can invest in sustainable agriculture practices, irrigation systems, and agro technology to boost production and profitability. With the global demand for high-quality and organic foods on the rise, Tanzania's agricultural sector also presents a promising potential for economic growth and job creation.

2. Tourism & Hospitality

Tanzania's tourism and hospitality industry is one of the country's most vibrant economic branches, with tourist millions flocking annually to world-renowned locations such as Serengeti National Park, Zanzibar's stunning coastline, and Africa's highest mountain, Mount Kilimanjaro. Tanzania's diverse landscapes, rich wildlife, and cultural background create a great demand for different tourism services. There are several investment prospects in ecotourism, such as greater interest in nature-friendly travel experiences, and luxury lodges, safari lodges, and adventure tourism. There is also scope for developing niche markets, like cultural tourism, wellness retreats, and community-based tourism enterprises, positioning the industry as a sought-after destination for domestic and foreign investors alike.

3. Mining & Natural Resources

The mining sector in Tanzania is among the country's economic pillars and among Africa's major resource-endowed nations. The country is Africa's fourth-largest gold producer, with significant investment flowing into gold mining operations, both artisanal and large-scale operators. Along with gold, Tanzania boasts enormous reserves of diamonds, tanzanite (a gemstone found only in Tanzania), graphite, and rare earth minerals that present diverse opportunities for exploration and production. With local processing and value addition supported by government policy, the investor can seek business in mineral processing and export. The sector is also benefiting from infrastructure development and regulatory changes that have the aim of attracting responsible mining investment.

4. Energy & Infrastructure

Tanzania's energy and infrastructure sectors are in a period of rapid growth on the strength of increasing electricity consumption and improved road infrastructures. There is heavy investment in renewable energy, and investment opportunities are being presented in solar, wind, and hydropower power project projects that seek to enhance urban and rural areas' access to electricity. In addition, massive infrastructure development projects such as road upgradation, upgradation of railways-including the SGR-and port upgradation are being planned in order to enable economic growth and intraregional trade. The high-value investment opportunities of these projects are attractive to energy production, construction, and logistics companies and position Tanzania as a key infrastructure and energy development center in East Africa.

5. Manufacturing & Industrialization

Tanzania's manufacturing and industrialization sector is one of the areas of focus in the government's economic development strategy to encourage domestic production to reduce the demand for imports. The country has massive potential for the processing of food, textiles, cement, and pharmaceuticals, both for the domestic and external markets. As a result of increasing population and urbanization, the domestic consumption of locally produced goods is on the increase, creating a conducive investment climate. Furthermore, special economic zones (SEZs) and industrial parks provide tax breaks and infrastructural facilities, making Tanzania an attractive place to conduct industrial and manufacturing operations.

6. Information & Communication Technology (ICT)

Tanzania's ICT sector is growing at a rapid pace with increased internet penetration and usage of mobile money services like M-Pesa and Tigo Pesa. With a tech-savvy young population, the country provides enormous opportunities in fintech, e-commerce, and IT services. Entrepreneurs and investors can tap the opportunity from digital payments, online platforms, and software development demands. The government is also enabling ICT development through initiatives such as the National ICT Broadband Backbone that enhances connectivity across the nation. As digital transformation accelerates, Tanzania's ICT industry continues to offer promising opportunities for business and innovation development.

Legal and Regulatory Framework in Tanzania

Understanding Tanzania’s legal and regulatory framework is essential for doing business in the country. Key laws and regulations include:

- Companies Act: Governs the incorporation and operation of companies in Tanzania.

- Investment Act: Provides incentives for foreign investors, including tax holidays and duty exemptions.

- Employment and Labor Relations Act: Regulates labor practices and employee rights.

- Tax Administration Act: Outlines tax obligations and procedures for businesses.

Business Registration & Licensing in Tanzania

To legally operate a business in Tanzania, you must register it with the relevant authorities.

✔ Business Registration: Register a business name with the Business Registrations and Licensing Agency (BRELA).

Choose a structure: Sole proprietorship, partnership, or limited liability company.

✔ Company Incorporation: Foreign investors typically register a Limited Liability Company (LLC) under the Companies Act, 2002. Minimum of two shareholders and two directors required. The company must have a registered office in Tanzania.

✔ Licensing & Permits: General businesses require a Business License from local authorities. Specific industries (mining, telecom, banking) require sector-specific licenses.

✔ Investment Registration: Large-scale projects for foreign investors should register with the Tanzania Investment Centre (TIC) for incentives.

Taxation in Tanzania

Tanzania’s tax system includes corporate taxes, VAT, and other business-related levies.

|

Tax Type |

Description |

|

Corporate Tax |

Standard corporate tax rate is 30% for resident companies. Small and Medium Enterprises (SMEs) are taxed between 5%–30%, depending on turnover and business structure. |

|

Value-Added Tax (VAT) |

A flat 18% VAT is applied to most goods and services, except for exempted or zero-rated items. |

|

Withholding Tax |

A 10% withholding tax is applied on dividends, interest, and royalties paid to residents. Different rates may apply for non-residents based on tax treaties. |

|

Payroll Taxes |

Pay As You Earn (PAYE) applies to employee salaries on a progressive scale from 9% to 30%. Employers and employees each contribute 10% to social security schemes. |

|

Customs Duties |

Duties vary according to the East African Community (EAC) Common External Tariff, typically 0%–35%, depending on the category of imported goods. |

These tax policies are subject to updates, so businesses should stay informed about changes from the Tanzania Revenue Authority (TRA).

Foreign Investment & Ownership Rules in Tanzania

Here's an overview of key foreign investment and ownership rules in Tanzania:

- Foreign investors can own 100% of most businesses, except in certain restricted sectors.

- Land ownership is restricted—foreigners can only lease land through the Tanzania Investment Centre or joint ventures.

- Repatriation of profits is allowed, provided tax obligations are met.

- Foreign investors are subject to Tanzanian tax laws, including corporate income tax, VAT (Value Added Tax), and withholding taxes.

- The Tanzania Investment Centre (TIC) offers various incentives to foreign investors in priority sectors, such as tax holidays and import duty exemptions.

- Foreign investors are generally required to comply with Tanzanian labor laws, including regulations regarding employment contracts, minimum wages, and working conditions.

Labor Laws & Employment Regulations in Tanzania

Tanzania has a well-defined legal framework governing employment relationships, ensuring that both employers and employees are protected under the law. These regulations cover key aspects such as contracts, work permits, wages, and termination policies. Below is an overview of the essential labor laws and employment regulations in Tanzania.

- Employment Contracts: Employment contracts must be in writing if the duration of employment exceeds six months. These contracts should outline essential terms, including job responsibilities, salary, working hours, and termination conditions.

- Work Permits & Visas: Foreign employees must obtain both a work permit and a residence permit before legally working in Tanzania:

- Work permits are issued by the Ministry of Labour and grant permission for foreigners to be employed in the country.

- Residence permits are managed by the Immigration Department and allow foreign employees to reside in Tanzania legally.

- Minimum Wage: The minimum wage in Tanzania varies depending on the industry and sector. The government periodically reviews and adjusts wage rates to align with economic conditions and living costs.

- Working Hours: The standard workweek in Tanzania is 45 hours, spread over five to six days. Any hours worked beyond this threshold may be subject to overtime pay as per labor laws.

- Severance Pay: Employers are required to provide severance pay if an employee is terminated unfairly or without just cause. The compensation amount depends on the length of service and specific circumstances of the termination.

Tanzania's labor laws aim to protect workers' rights while ensuring a stable and fair working environment for businesses. Employers must comply with these regulations to maintain lawful employment practices.

Business Cultural Considerations in Tanzania

Understanding Tanzanian culture and business etiquette is crucial for building strong relationships and succeeding in the market. Here are some key cultural tips to consider:

- Relationships Matter: Building trust and personal relationships is essential in Tanzania business culture.

- Hierarchy and Respect: Tanzanian society is hierarchical, and it’s important to show respect to elders and those in positions of authority.

- Communication Style: Tanzanians value politeness and indirect communication. Avoid being overly aggressive or confrontational.

- Dress Code: Business attire is generally formal, with men wearing suits and women wearing conservative dresses or suits.

Challenges of Doing Business in Tanzania

While Tanzania offers significant opportunities, businesses must navigate several challenges:

- Bureaucracy: Complex and time-consuming administrative processes can delay business operations.

- Infrastructure Deficits: Poor infrastructure, especially in rural areas, can increase costs and logistical challenges.

- Access to Finance: Limited access to financing, particularly for small and medium-sized enterprises (SMEs), is a common issue.

- Corruption: Despite government efforts, corruption remains a challenge in some sectors.

- Skills Gap: The education system does not always produce graduates with the skills needed by employers.

Tips for a Successful Business in Tanzania

Here are key strategies to help you navigate and thrive in the country.

- Understand Local Business Culture: Personal relationships matter—building trust with partners and government officials is key.

- Work with Local Experts: Hire legal and tax consultants to navigate regulations.

- Leverage Government Incentives: Register with the Tanzania Investment Centre for tax breaks and support.

- Have a Strong Compliance Strategy: Keep up with regulatory changes to avoid penalties.

- Learn Basic Swahili: It helps in negotiations and relationship-building.

Content Disclaimer: While this information was last updated in March 2025, we strongly suggest confirming all travel details with the appropriate governmental agencies, embassies, and airlines.

To help us improve