Tanzania is a dream destination for travelers, offering breathtaking safaris, pristine beaches in Zanzibar, and the iconic Mount Kilimanjaro. While planning your trip, one crucial aspect to consider is travel insurance. Whether you’re embarking on a wildlife safari, trekking to Africa’s highest peak, or exploring local cultures, travel insurance ensures financial protection against unforeseen events such as medical emergencies, trip cancellations, and lost baggage. Travel insurance for Tanzania covers medical emergencies, trip cancellations, and lost luggage. A Tanzania eVisa is required for entry and can be conveniently applied for online before traveling.

Is Travel Insurance Required for Tanzania?

Travel insurance is not legally required to enter Tanzania, but it is highly recommended for all travelers. It provides financial protection against unexpected situations such as medical emergencies, trip cancellations, or lost luggage.

- Some travel activities, such as climbing Mount Kilimanjaro, require mandatory medical evacuation insurance.

- If you’re traveling with a tour operator or safari company, they may require proof of travel insurance.

- Medical care in remote safari areas can be expensive, and travel insurance can cover emergency evacuations.

- Comprehensive policies also protect against flight delays, theft, and other travel disruptions.

Travel Tip: Even though it’s not mandatory, having travel insurance can save you from high unexpected costs and give you peace of mind.

Why Do You Need Travel Insurance for Tanzania?

Traveling to Tanzania is an exciting adventure, but unexpected events can disrupt your trip. Having travel insurance provides financial protection and peace of mind in case of emergencies. Here’s why it’s essential:

1. Medical Emergencies & Hospitalization

Tanzania has limited healthcare facilities, and serious medical cases may require emergency evacuation to Nairobi or South Africa.

- Medical expenses can be very costly, especially if you need helicopter evacuation from a remote safari park.

- Some hospitals may require upfront payment, and travel insurance ensures you’re covered.

Example: If you contract malaria and need hospitalization, your travel insurance will cover the medical expenses instead of paying out of pocket.

2. Emergency Evacuation & Repatriation

Accidents and severe illnesses can happen anywhere, and evacuation costs can be extremely high.

- If you suffer a serious injury or illness, emergency evacuation to a well-equipped hospital is crucial.

- If necessary, insurance will cover the cost of medical repatriation to your home country.

Example: If you break a leg while trekking Kilimanjaro, insurance covers the helicopter evacuation to a hospital.

3. Trip Cancellations, Delays & Interruptions

Travel plans don’t always go as expected, and cancellations or delays can result in financial losses.

- Flights to Tanzania can be expensive, and unexpected cancellations or delays can disrupt your plans.

- Insurance can reimburse you for non-refundable expenses like flights, hotels, and safari bookings.

- If you need to return home due to an emergency, your insurance may cover the additional costs.

Example: If your flight is canceled due to bad weather, your insurance can refund pre-paid safari accommodations.

4. Lost, Stolen, or Delayed Baggage

Losing your luggage or having it stolen can be a major inconvenience, especially on a long trip.

- Baggage loss or theft can be a hassle, especially if traveling with expensive camera gear or hiking equipment.

- Insurance can compensate for delayed, lost, or stolen luggage.

Example: If your checked baggage with safari clothes is lost, insurance can cover the cost of replacing essential items.

5. Adventure & High-Risk Activities Coverage

Tanzania offers thrilling activities, but some may not be covered under standard travel insurance.

- Standard travel insurance may not cover high-risk activities like:

- Climbing Mount Kilimanjaro

- Scuba diving in Zanzibar

- Hot air balloon safaris in Serengeti

- If you plan on adventurous activities, ensure your policy includes coverage for extreme sports.

Travel Tip: Always check if your insurance covers altitudes above 5,000 meters if climbing Kilimanjaro.

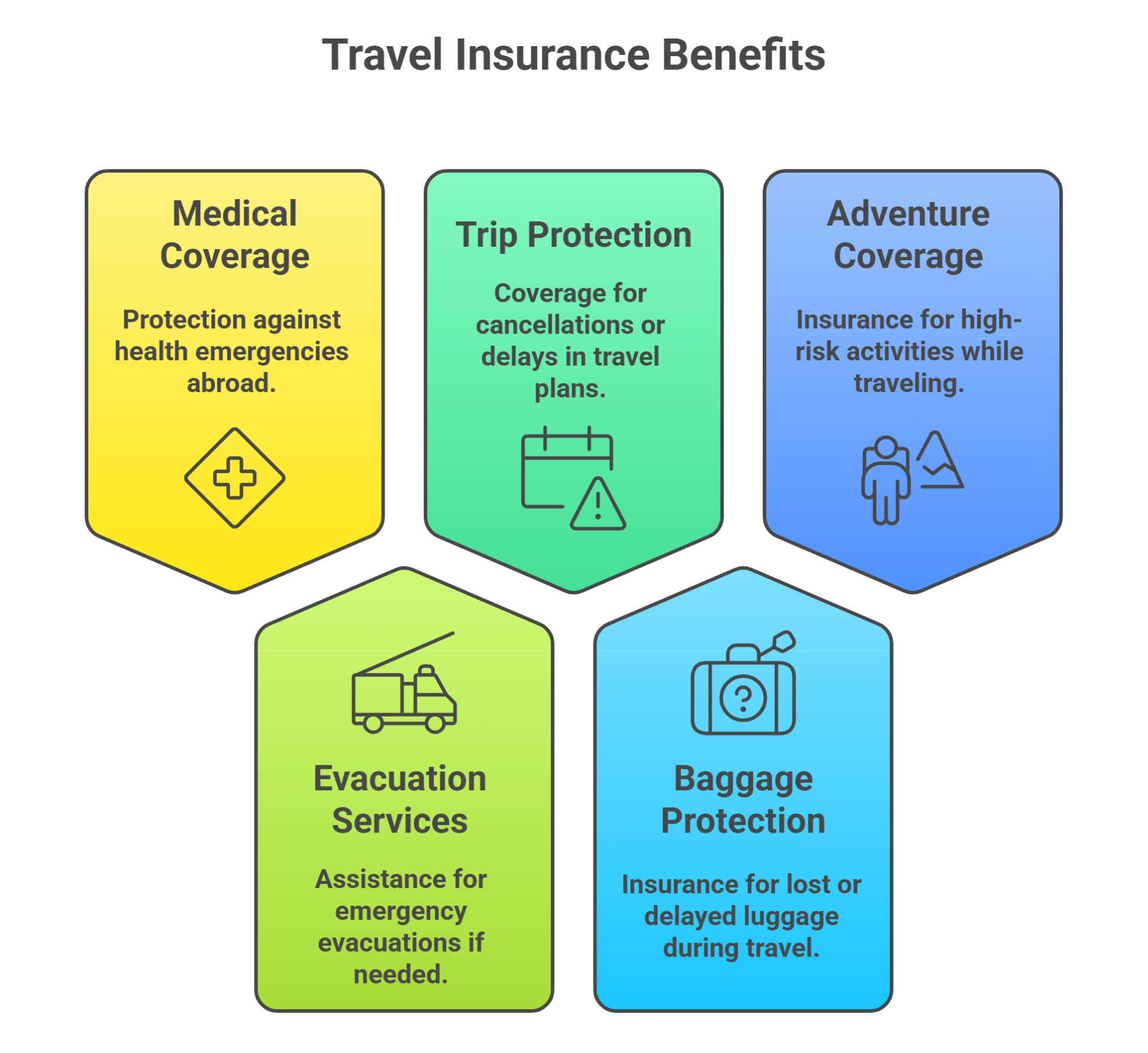

What Should Your Travel Insurance Cover for Tanzania?

When selecting a travel insurance policy for Tanzania, ensure it includes the following key features:

|

Coverage Type |

Why It’s Important |

|

Comprehensive Medical Coverage |

Covers emergency medical expenses, hospitalization, and medical evacuation. Essential for those engaging in high-risk activities. |

|

Trip Cancellation & Interruption |

Reimburses non-refundable expenses if your trip is canceled or cut short due to unforeseen circumstances. |

|

Coverage for Adventure Activities |

If you plan to climb Mount Kilimanjaro, go on a safari, or scuba dive, ensure your policy explicitly includes these activities. |

|

Theft & Loss Protection |

Protects against the loss or theft of personal belongings, including passports, cameras, and electronic devices. |

|

Emergency Evacuation & Repatriation |

Critical for travelers in remote areas, covering costly emergency evacuations and transport back home if needed. |

|

24/7 Assistance Services |

Provides round-the-clock customer support for medical emergencies, lost documents, and other travel issues. |

Always read the fine print and ensure that your specific activities (like safaris or trekking) are covered.

Best Travel Insurance Providers for Tanzania

Several international insurance companies offer comprehensive coverage for Tanzania. Here are some top options:

- World Nomads: Known for its adventure travel coverage, World Nomads is a popular choice for travelers visiting Tanzania. It covers activities like safari tours, hiking, and diving. Covers lost luggage, trip cancellations, and delays

- Allianz Travel Insurance: Allianz offers flexible plans with extensive medical and trip cancellation coverage with emergency evacuation, making it a reliable option for Tanzania. Its is best for family travel and multi-trip insurance

- AXA Travel Insurance: AXA provides robust coverage for medical emergencies, trip interruptions, and adventure activities, ideal for Tanzania travelers.

- SafetyWing: A great option for long-term travelers or digital nomads, SafetyWing offers affordable and flexible plans with medical and evacuation coverage.

- IMG Global: IMG specializes in international travel insurance and offers customizable plans for travelers visiting Tanzania.

- InsureMyTrip: Compares multiple travel insurance plans to find the best option for your needs. It is ideal for travelers looking for customized coverage

How to Choose the Best Travel Insurance for Tanzania

Selecting the right travel insurance for your trip to Tanzania is essential for a worry-free experience. Here are key factors to consider:

- Consider Your Activities: If trekking Kilimanjaro or going on safari, ensure adventure sports coverage is included.

- Check Medical Limits:Medical evacuation.

- Look for Trip Cancellation Coverage: Protects non-refundable flights, safaris, and hotels.

- Compare Policies: Use comparison websites like InsureMyTrip to find the best deal.

- Read the Fine Print: Understand exclusions, such as coverage limits on pre-existing conditions.

Pro Tip: If traveling with expensive camera gear for photography, add extra coverage for electronics.

How to Buy Travel Insurance for Tanzania

Purchasing travel insurance is a simple but crucial step before your trip to Tanzania. Follow these steps to ensure you’re covered:

- Compare different insurance providers and select the best plan based on your travel activities and coverage needs.

- Purchase insurance online before traveling to ensure you’re protected from the moment your trip begins.

- Print a copy of your insurance policy and keep it with you in case you need to present it during your trip.

- Save emergency contact numbers of your insurance provider for quick access in case of any issues.

Tips for Choosing the Right Travel Insurance for Tanzania

Here are tips for travelers purchasing a travel insurance to Tanzania:

- Compare Policies: Use comparison websites to evaluate different insurance providers and their offerings. Look for policies tailored to adventure travel or African destinations.

- Check Exclusions: Read the fine print to understand what’s excluded from your policy. For example, some plans may not cover pre-existing medical conditions or certain high-risk activities.

- Consider Your Itinerary: If your trip includes multiple destinations, ensure your policy provides worldwide coverage or specifically includes Tanzania.

- Buy Early: Purchase your travel insurance as soon as you book your trip to ensure coverage for cancellations or delays that might occur before your departure.

Frequently Asked Questions

Is travel insurance mandatory for Tanzania?

No, but it is highly recommended for medical emergencies and trip protection.

Does travel insurance cover malaria treatment?

Yes, most travel insurance policies cover malaria treatment, but check specific policy details.

Can I get insurance that covers Kilimanjaro climbing?

Yes, but make sure it covers altitudes above 5,000 meters. World Nomads is a good option.

What should I do in case of a medical emergency in Tanzania?

If you experience a medical emergency while in Tanzania, follow these steps:

- Call your insurance provider’s emergency helpline immediately for guidance and approval of medical expenses.

- Seek treatment at a recognized hospital or clinic to ensure proper medical care.

- Keep all medical receipts and documents for reimbursement and claims processing.

Content Disclaimer: While this information was last updated in March 2025, we strongly suggest confirming all travel details with the appropriate governmental agencies, embassies, and airlines.